You are here because someone told you about it.

When you saw the URL,

a voice in your head said,

"Improve My Trades?

Hmmm...

I Wanna Do That!"

When you saw the URL,

a voice in your head said,

"Improve My Trades?

Hmmm...

I Wanna Do That!"

This is about a 7 minute read.

Before we start,

I have one simple request for you...

As you read this,

Read it out loud,

I'm not kidding!

READ IT OUT LOUD .

When you do,

People will look at you sideways;

So what!

If you trade,

you're used to people looking at you sideways,

becuz they don't understand what you do...

so it doesn't matter what others think.

Read it out loud.

Think back to when you were first learning to trade,

you’d look at a chart and say:

“I could have bought xyz right here

and sold it right there.

I would have made x amount of money.

Wow!

This is going to be awesome!”

Fast-forward to today...

Now you look at a chart and say:

“I could have bought xyz right here

and sold it right there.

I would have made x amount of money.

Dammit!

Why didn’t I do that?

Argh! So Frustrating! “

It is a constant struggle.

Not being consistent is very frustrating.

What’s the difference between

“when I first started”

and

“today”?

The difference:

Your psychology.

It got in the way.

When your psychology gets in the way, here’s what happens:

You close a trade and say to yourself, “What the heck did I just do? This is not like me, I know better than that!”

You get angry at the market, and decide to get even by revenge trading.

You’ll hesitate or skip a good setup becuz you're afraid of another loss, or fear of being wrong etc.

You're in a winning trade, but you close it before the profit target, becuz you "need" the win.

You’ll let a loser run, hoping it comes back to breakeven, and then freeze as the loss get even larger.

You’ll add money to a losing position, lowering your cost basis so it's easier to break even.

You’ll convert a losing short-term trade into a long-term investment.

You’ll stay in a trade beyond your profit target, hoping for a home run.

After a profitable period, you get over-confident and your trading suffers.

You can get more aggressive after losing money (aka “FILG, F*** It, Let’s Go)

You get bored - before you know it, you’re in a trade that doesn’t meet your criteria.

You’ll impulsively jump into unplanned trades when market volatility starts kicking in.

You will stop trading or reduce your trade size after a loss.

You won't enter a trade because your last few trades were losers.

After a big loss taught you now take quick, small losses; but you take quick profits too; and now can never get a sizable win;

You act like a cockroach...the light turns on and you run for cover.

You ignore your money mgmt rules by adjusting your trade size after a series of wins or losses.

Etc

All of the above are symptoms of your psychology getting in the way.

It is a constant struggle.

It’s SO FRUSTRATING to be inconsistent.

How can you fix it?

Let’s go back to when you first got into trading…

WHY did you first get into it?

For most people, it’s “the money”.

Maybe you wanted the money to buy “things”.

It might have been to buy something for you:

Maybe, equipment for that home gym you’ve always wanted;

or

It might have been something for the family:

Braces for your kid;

A family vacation;

A new car.

Remember - Read it out loud!

As you thought about it,

you realize that you don’t just buy "things",

you also can buy "time":

"Buying time" is hiring a maid service and/or a gardener.

or

pay a handyman to do house projects.

When you hire someone to do basic tasks,

it frees up your time.

As you think bigger,

You realize that when your trading results match your income from your job,

trading buys you FREEDOM.

Freedom to walk away from your job;

Freedom to do what you want,

where you want,

when you want.

The term we like to use is Time Freedom.

That's where we are.

I don't like saying "I promise"

but in this case,

I'm very comfortable saying

I promise..

Time Freedom is an awesome spot to be.

I can't say it strongly enough:

Bust your tail to reach time freedom.

It is an awesome spot to be.

Work your butt off.

I promise:

you will be sooo glad you did.

There are three elements that comprise trading:

1) Your trading method.

2) Your money management approach.

3) Your psychology

(aka "mindset" or "way-of-thinking").

No one disputes the importance of a trading method;

No one disputes the importance of money mgmt.;

Yet, most traders can’t identify if & where their psychology impacts them.

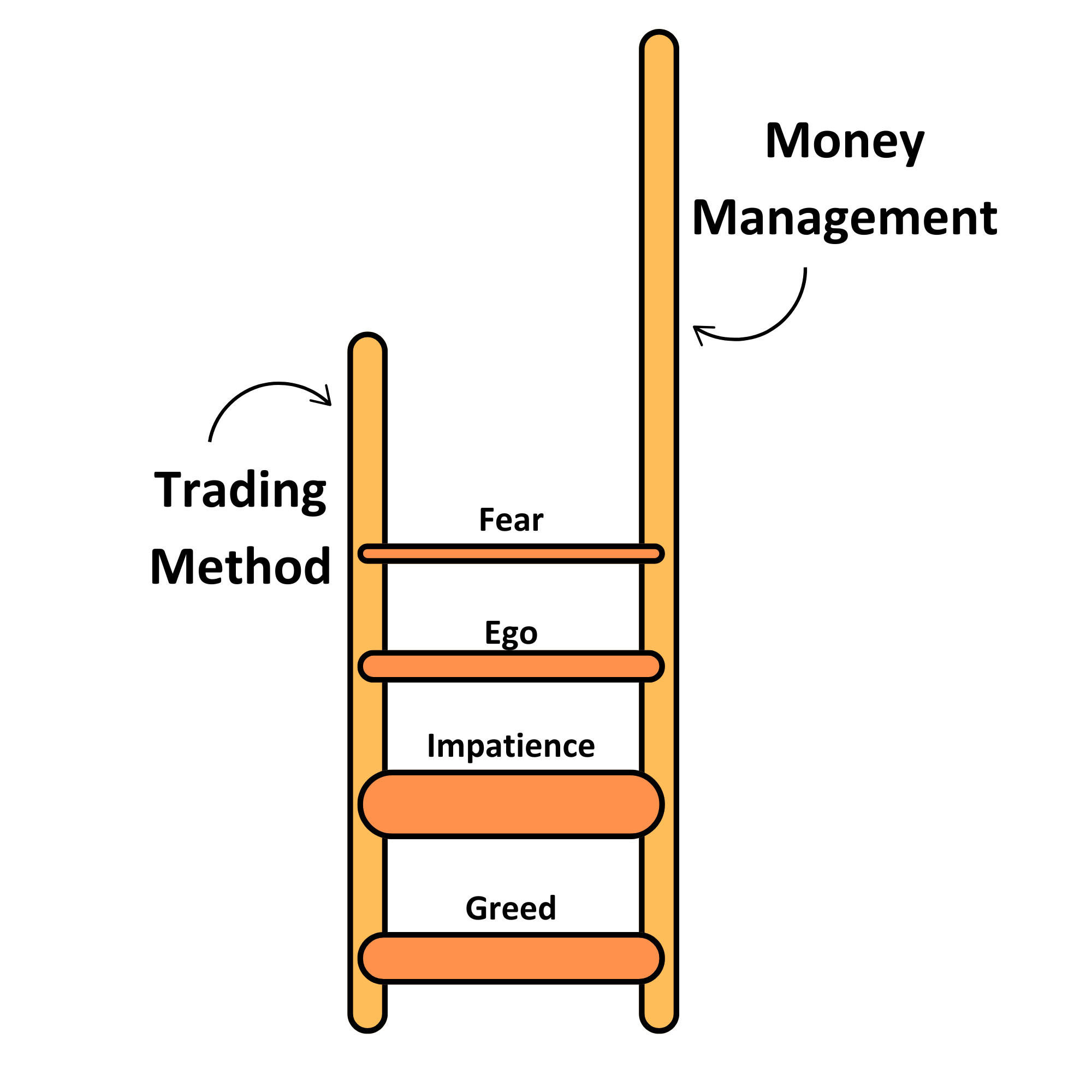

Here’s an easy way to explain the importance of psychology in trading:

Your task is to build a ladder;

You’ll need rungs;

you’ll need a left rail,

and a right rail.

The rails are not the same length.

As you assemble the parts.

You have an "aha moment":

The height you can reach is limited by the shortest rail.

And that assumes two things:

1) You have enough rungs;

2) Each rung can support your weight.

Let's go back to the three elements that comprise trading.

1) Your trading method - think of it as the left rail.

2) Your money management approach - the right rail.

3) Your psychology - the rungs.

Now, Take a Moment and think about your recent trading results:

“Recent” could be your last 20 trades;

or

“Recent” could be all of last year's trades;

or

All your trades from the past few years.

You decide.

Which of the 3 elements has the biggest impact on your results?

Is it the left rail that’s limiting the height of your ladder?

Said differently - Is your trading method holding you back?

or

Is the right rail limiting the height of your ladder?

Said differently - Is your money mgmt strategy holding you back?

or

Are your results impacted by the number of rungs available?

You earn a rung once you have overcome a psychology issue.

Examples include

greed,

fear,

confidence,

impulsiveness,

self-worth,

impatience,

and there are many more.

Think of each one of them as a rung on your ladder.

And also:

Can each of the rungs support the weight (the trade size)?

For example:

Today, you enter a trade using your current trade size;

Now, add an extra zero onto your trade size...

Do you have that uncomfortable feeling of:

"Ouch! What if it goes against me?"

or

Do you get that rush of greed and excitement:

"Hmmm....that would be a nice, big win!"

Now, let's think bigger...

Imagine two more zeroes on your trade size;

Notice that extra dose of emotion you're feeling,

Can you perform under that level of pressure?

A larger trade size puts more pressure on each rung of the ladder.

That means the rungs have to be strong.

That means your psychology has to be strong.

To improve your results,

one or more of the three elements has to change.

Which one should you look to improve?

Most traders choose their trading method.

They will tweak it;

They’ve done it before;

They’re willing to do it again.

However...

How has that worked out so far?

The answer:

Not Very Well.

How can I say that?

I don’t even know you!

The reality:

If you like your results,

you wouldn’t be reading this.

Those who continually tweak their trading method

either

don’t recognize,

or

Are unwilling to admit,

That what continually trips them up is:

They don't recognize their reaction to their emotions.

Remember this reality:

Trading is the one endeavor that regularly makes “smart” people behave very stupid.

Let me repeat:

Trading makes “smart” people do stupid things.

It’s not your trading method that makes you do stupid things;

It’s your psychology that makes you do stupid things.

Some of you are very intelligent;

Highly educated;

Graduated from a top school;

You may have an advanced degree.

If you know that you are "smarter" than most,

trading psychology isn't affecting you.

If you resonated with the prior statement,

Slow your roll, ego-boy!

If you're so smart,

why aren't you at Time Freedom?

Within the FAQ tab,

there are a few stories about

brilliant people who got pummeled in the market.

Pummeled becuz their psychology overpowered their brilliance.

What's my definition of "brilliant" people?

Sir Isaac Newton;

Myron Scholes;

(Scholes won Nobel Prize for developing options pricing model)

and others.

The reality:

Very few of us recognize/believe we are emotional;

Most of us believe we are logical and rational.

If you regularly deal with numbers,

someone who is data driven,

an engineer for example,

you likely assume that you are logical and non-emotional;

If you are in that category,

read this next part carefully:

In my experience:

data-driven people typically are THE most emotional traders,

and they don’t realize it!

It's fascinating!

Why?

Due to their training,

data-driven folks believe that if they study the data,

then they will be comfortable with their decision.

When they analyze the data,

They “feel good” about making a “logical” decision.

The reality:

That is emotional decision making.

one or more of those three elements has to change.

There are others who know their mindset is the issue,

but they choose to not face it.

The good news is:

Each contains interviews with about 15 of the world's top traders.

Each of them uses a different trading method.

Some trade stocks;

Some trade futures;

Some trade commodities, and Forex.

It doesn't matter what they trade,

nor how they trade:

Each of them says that psychology is the key to their success.

Let me say it again;

The reality:

Watch the class excerpts on the website;

Read the FAQ.

There is a booklist available.

We had to create what we were looking for.

We would have been thrilled to pay for it;

I think it was Robert Oppenheimer, father of the atomic bomb, said,

"There is no better way to learn than to teach;

Teaching forces us to distill complex ideas into understandable parts,

which then deepens our own understanding."

Writing this course has deepened our own understanding;

The material has had a dramatic impact on our results.

If no one ever purchases this, that's okay.

We're already far ahead,

simply by applying what is in the materials.

We've all seen the religious zealot,

standing on a busy street corner,

holding a sign saying

"Jesus Saves"

or

John 3:16.

There is no doubt that they are fervent in their belief.

You won't find us on a busy street corner,

preaching about trading psychology,

However, We have that same fervent belief about this material.

We are 100% certain that this can help you get closer to freedom;

IF you are willing to change your behavior.

we send monthly audio clips;

The goal is time freedom.

It can't be said strongly enough:

you will be so glad you did.